Table of Contents

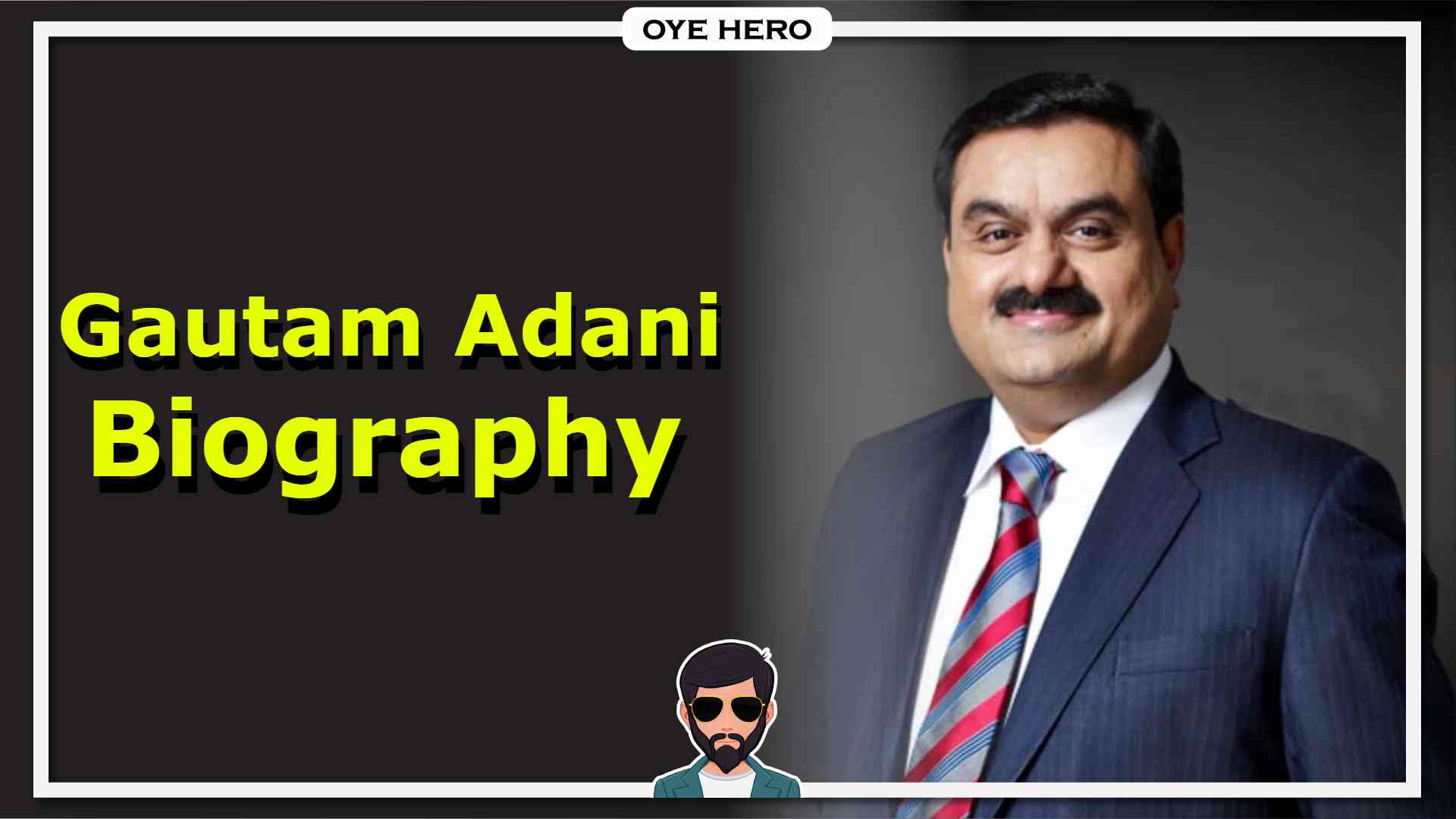

Gautam Adani Biography:

Adani, which is currently valued at roughly US$123.7 billion, is focused on sustainable energy and owns holdings in both Mumbai International Airport and Softbank.

He has three private jets, three choppers, a Ferrari, and a Rolls-Royce, and his Adani Group bought US$52 million for premium rental housing in New Delhi.

Quick facts:

Born: 1962

Nationality: Indian

Citizenship: India

Education: Gujarat University

Occupation: Businessman

Title: Founder of Adani group

Spouse: Married

Children: 2

Net worth: Not known

Current life:

Gautam Adani has consolidated his position on the world’s wealthiest list during the last two years. According to Forbes, Adani surpassed Warren Buffett to become the world’s fifth billionaire player at the end of April.

With his businesses in ports, airports, and electricity distribution, he has beaten fellow Indian billionaire Mukesh Ambani to the top of the wealthy list, with a net worth of US$123.7 billion.

Despite his meteoric climb to wealth, Adani is hardly unknown. He’s been regarded as a mysterious businessman who keeps much of his personal life and purchasing behavior hidden from view.

According to Forbes, Adani dropped out of education and launched a products export company in 1988. He was a billionaire by 2008. Adani is the creator of the Adani Group, which specializes in energy and ports.

It has six publicly traded companies in India, the highest of which has increased by 195 percent this year.

Forbes Calculations:

According to Forbes, Adani’s success stems from his leadership of ambitious growth tactics in renewable energy, airports, and media enterprises. The industrialist has stated that he will focus on renewable energy and plans to invest $70 billion in the industry.

Adani’s personal life and financial transactions are largely unknown. According to the India Times, he does not come from a wealthy family and earned his fortune through hard labour.

The Adani Group won its bid for Aditya Estates, which owned prime residential property, under bankruptcy proceedings, according to the paper.

This man owns Private jets:

Adani has three private jets at his disposal to ensure that his means of transportation is secure. Adani has a Beechcraft, Hawker, and Bombardier, per the India Times.

Adani has decided to spend on automobiles when he isn’t flying around in one of his private jets. His first form of transportation, according to the India Times, was a simple scooter in 1977.

He’s risen through the ranks and now has access to a variety of high-end vehicles, also with a BMW oneplus 7, Rolls-Royce Ghost, and Ferrari.

When you need to travel abroad for business, corporate planes come in useful. According to Shaadis, Adani likes to travel by helicopter and has purchased three for his personal usage.

Here comes his Net worth:

According to The Economic Times, Adani began as a commodities dealer in the late 1980s and today controls seven airports and over a fifth of India’s air traffic. However, electricity generated, clean energy, and transmission are now his main sources of profit.

According to Fortune, the Adani Group CEO bought a majority stake in Mumbai International Airport, the country’s fifth busiest airport, in September 2020.

He also profited handsomely after selling 20% of his company, Adani Environmental Energy, to French energy giant Total in January.

However, a showdown could be on the cards. On June 24, during the AGM of Reliance Industries Limited, Ambani stated that his business would be working on “becoming green.”

Furthermore, according to NDTV, Ambani has spent $10 billion in offshore wind farms, a move that is poised to spark a business deal between him and Adani, pitting India’s two wealthiest men one against another.

Richest man of Asia:

Gautam Adani, Asia’s richest man, bought 63.19 percent of Ambuja Cements Ltd and its subsidiary ACC after a bidding war with local enterprises.

Holcim’s divestiture is the latest step in its effort to lessen its dependence on cement manufacture, an agricultural process that emits high amounts of carbon emissions and has thus turned off many ecologically conscious investors.

In past years, the Swiss firm has stepped up its attempts to exit the nitrogen cement industry. Full shareholding of Ambuja and ACC through an offshore special purpose entity, the Adani Group said in a statement.

Holcim stated in a report that the Adani Group had executed a formal deal to buy Holcim’s Indian business, which includes its share. The interests would be worth about $6.4 billion to Holcim.The Adani Group said that it would make an open offer to buy more shares.

Adani and Cement Journey:

Our decision to enter the cement sector demonstrates our faith in our country’s booming economy and our own skills. We announced last year that we would be participating in this area and had already established Adani Cement as a completely holding company.

Two key elements have influenced this conclusion. The supply imbalance, as well as efficiencies with our other operations.

Synergies with our other operations, as well as a demand-supply asymmetry. Not only will India continue to be one of the world’s largest demand-driven nations for decades.

Despite producing less than half of the world’s terms of per capita limestone, it is the country’s third cement business.

When we integrate this cement customer preferences with the connections of our many current businesses, like the Adani Company’s ports and development of infrastructure, we get a lot of interesting results.

An Acquisition process:

The transaction is being carried out by an Adani family offshore special purpose entity that is not affiliated with any of the listed or operating enterprises.

The deal is fully funded thanks to agreements from our relationship banks – Santander, Deutsche Telekom, and Standard Chartered Bank – as well as an equity contribution from the Adani family.

We acknowledge that the cement industry must become more environmentally friendly, and I am certain that we are ideally qualified to become the world’s healthiest cement supplier while also providing the economics that just about every Indian customer requires.