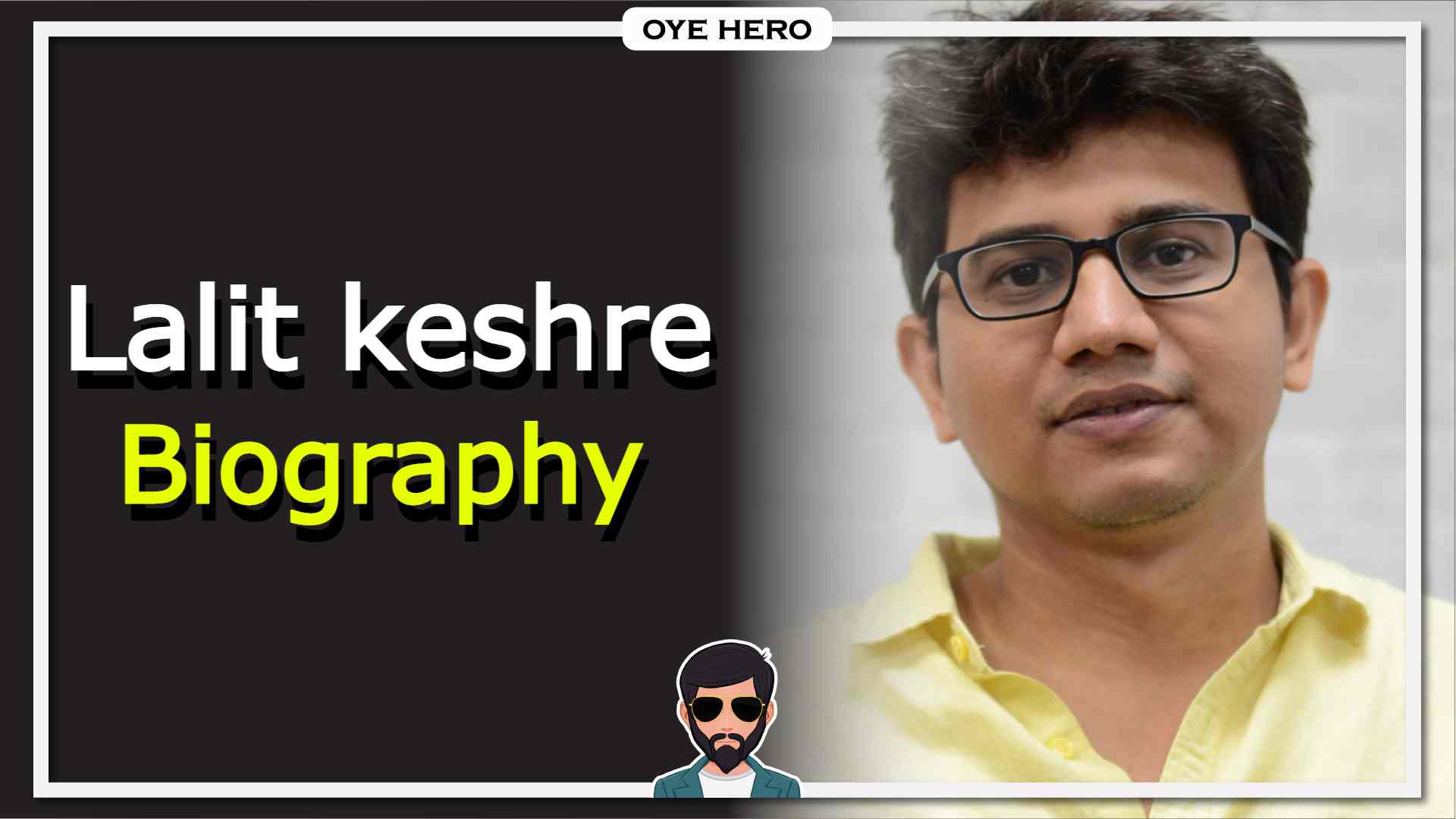

Lalit Keshre is an Indian businessman and industrialist. Groww, an Indian investing platform, is his co-founder and CEO. Keshre and his colleagues built a one-of-a-kind company that provides people in India with a platform for developing assets without charging them a fee.

Table of Contents

Quick facts:

Education: Graduated in IT Bombay

Nationality: India

Title: Businessman and Industrialist

Net worth: 1,80,000$

Investment opportunities in India:

Due to a lack of customer trust and information, entrepreneurship in India has continued mostly conventional. Things have changed, though, as many areas of our daily lives become more computerised.

Online investment platforms have not only made buying simple, but they have also provided customers with access to previously unattainable financial tools. Just several startups have jumped on this digital investment opportunity and are paving the way for millennials in India to invest.

Groww is one such firm that has attracted not only a large customer base but also notable capitalists such as Startups and Sequoia Capital. Right after graduating from IIT, Keshre and Jain began work together at a startup, but while they parted ways for a while, they reconnected at Flipkart and were assigned to almost the same team.

Grow as best investment plan:

During our time at Flipkart, we saw that, despite the economic services industry’s size, there is a significant gap. Traditional assets such as fixed deposits are used by millions of people to save money. The wealth in India is expanding, shifting from traditional assets to financial assets, so everything is moving online.

Because we come from an internet history, we understand clients well enough, and that’s when management understood they needed to develop a product that could take advantage of this.

Business is scalable:

The first is a consumer obsession. I was astounded by how central client obsession is to the strategic and operational decision, and this is something we’ve carried through it Grow though too.

The magnitude was the second issue. I’ve never seen something on that scale before. Most of my coworkers have never seen something on that scale before. Basically, you begin small and quickly expand.

Grow as game-changer:

The first priority should be to make things simple for people, and the second should be to educate them. So far, the financial services business has focused on selling rather than buying financial products.

Ultimately, nobody says to themselves, “Let me buy mutual fund schemes this early.”

People will phone you and try to sell you mutual funds and other investments. That really is how it’s always been, but now, thanks to services like Groww, you have access to all of the knowledge you need, just like you do on online marketplaces like Flipkart or Amazon.

Technology and Grow:

We’re geeks, and there’s a lot of technology under the hood. We make extensive use of technology. There is a significant variance in the approval process depending on the magnitude of the investment and everything else.

If you go to our app and look at any fund, we present the information in some of the most customer way possible so that the user is not put off. So that’s the gentler side of the process.

Team is strength:

We bring a customer-focused approach to the table, I believe. In our industry, there are two types of customers: customers and finance and insurance. It has a significant impact on customers in a variety of ways. One would be capital; having capital gives you more certainty.

Second, some of these investors have sponsored well-known firms and so have the experience to assist a startup other than ours grow first from ground up. They bring a wealth of knowledge and expertise with them, and I feel that as entrepreneurs, we can benefit much more from their expertise financing other firms.

They will be concentrating on India over the next few years. In terms of products, our ambition would be to become a one-stop shop for all investment options. Groww should therefore come to mind when users consider investing.

And currently, they have all of India’s mutual funds. We’ll be launching stocks in the next months, and we’ll be expanding into more product types soon afterward.